Move beyond assumptions. Build a real-time view of what shoppers want.

Shopper habits change daily. Channels blur. Expectations rise.

But your research is still stuck in slow cycles.

Conveo shows you what shoppers really think, feel, and do through AI-led video interviews that scale like quant and reveal the why behind the what.

used by

Still running shopper research like it’s 2015?

Rigid tracking studies

Static personas

Focus groups that cannot capture how people really shop

Surveys that surface trends after they’ve peaked

Research locked in decks, not fueling daily decisions

Launch calendars keep accelerating

Merchandising, brand, and CX teams need real-time input

Shoppers are harder to reach, and quicker to switch

Experience now trumps everything and the bar is as high as ever

Omni-channel behavior is complex and context-dependent

the result

Retailers rely on outdated insights to make decisions that move too fast for old-school research.

Know more. More often.

Leading retail teams use Conveo to:

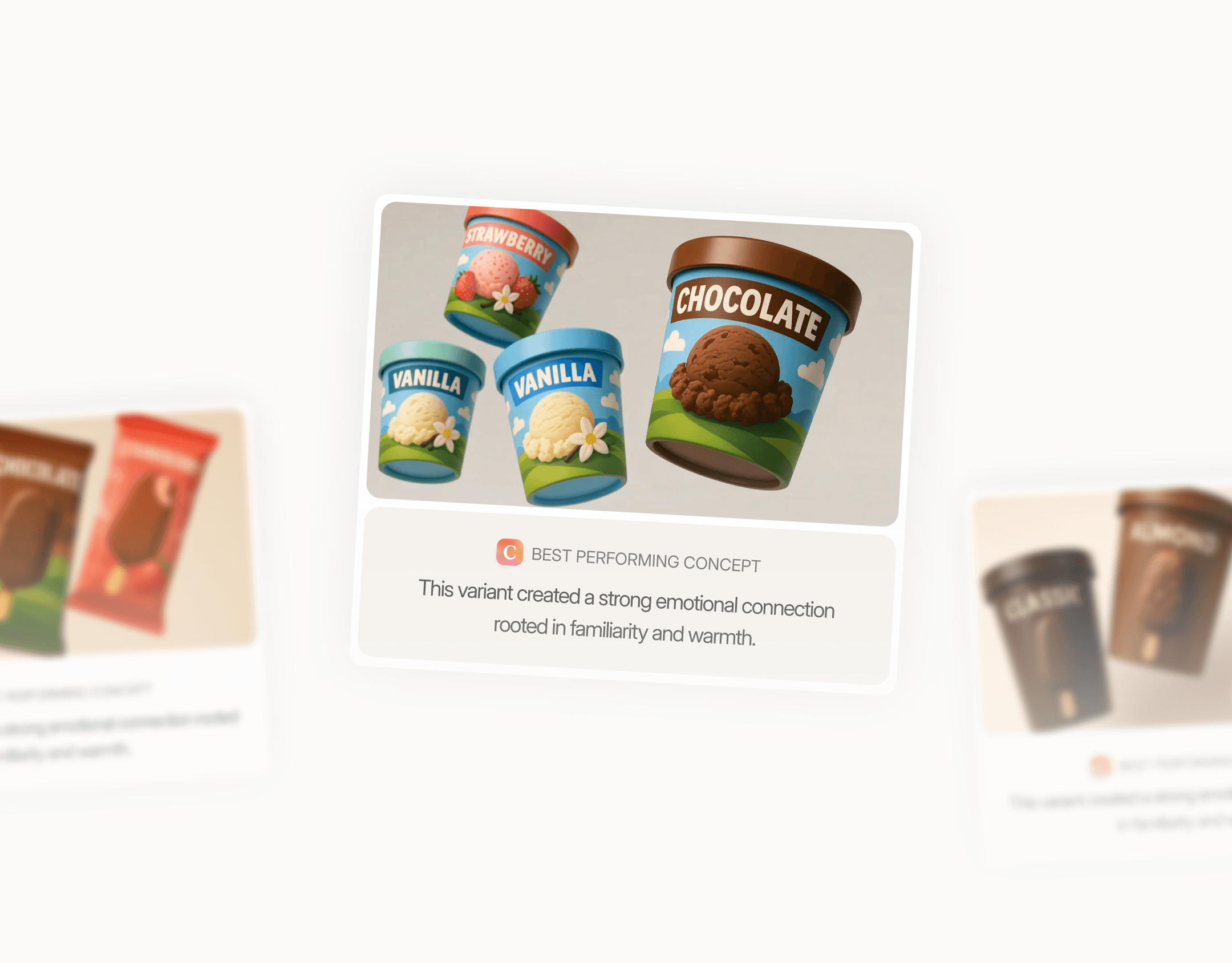

Test packaging, displays, signage, and messaging before they go live

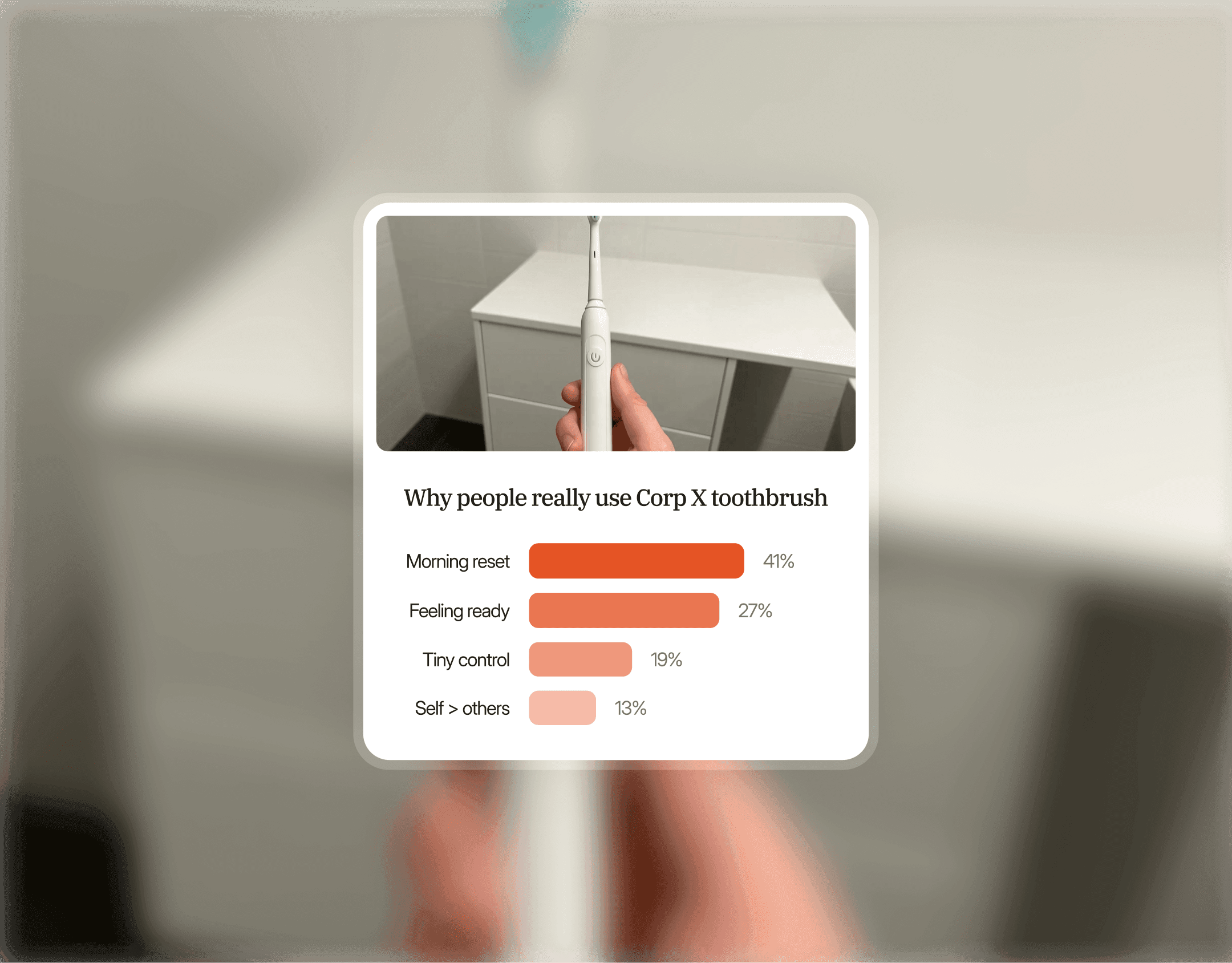

Understand in-store and digital behavior through unfiltered video feedback

Capture reactions to layout, navigation, and visual merchandising

Iterate on new concepts with daily feedback loops

Build a scalable system of shopper insight across markets

Behavioural qual + AI = automated empathy

Conveo brings that voice forward, fast and at scale:

Hear how people navigate your store or site and why they bounce

Understand emotional reactions to product, price, or promo

Identify friction in the shopper journey before it hurts sales

Pinpoint what drives loyalty, delight, and repeat behavior

Feed insights directly into product, trade, CX, and marketing teams

Built for retail reality

Global reach across 100+ countries

AI-led interviews in 50+ languages

No scheduling, no moderators, no field delays

Instant summaries, quotes, highlight reels, and themes

Designed for Insights, Marketing, Visual Merch, Innovation, Trade, and CX

Fully human voices, no synthetic data, ever

Where it starts to feel different

Smarter, faster merchandising decisions

Reduced risk on new campaigns, collections, and launches

Stronger in-store and digital alignment

Shopper feedback that actually fuels change, not just slides

A growing knowledge base of what really drives behavior

According to McKinsey, Forrester, and Kantar:

Retail industry is evolving, fast

64%

of retail leaders say their biggest blind spot is why shoppers behave the way they

70%

say their research cycles can’t keep up with planning

1/4

Only 1 in 4 feel confident in how they gather qualitative insight today